how are annuities taxed to beneficiaries

Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities.

Trust Vs Restricted Payout As Annuity Beneficiary

How Annuities Are Taxed.

. When you make withdrawals or begin taking regular payments from the annuity that money will be taxed as ordinary income. Learn some startling facts. Any money you take out before age 59½ will also.

How it is taxed. Qualified annuity taxation. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

But taxation on contributions and. If you have an annuity contract you can choose a beneficiary to receive the remaining payments or lump sum death benefit if you die. Ad Learn More about How Annuities Work from Fidelity.

Interest earned in a deferred annuity the most popular type is. Usually a 401k or another tax-deferred. Yes any earnings from inherited annuities are subject to taxation.

An annuity is qualified if you purchase it with pre-tax dollars via a tax-advantaged account such as an IRA or 401k. In particular most annuities have a death benefit and understanding how that death benefit will get taxed to the beneficiary who receives it is an important part of deciding. How Are Annuities Taxed.

What this means is taxes are not due until you receive income payments from your annuity. Beneficiaries of Period-Certain Life Annuities. Annuities are designed to build wealth and income for your retirement through tax deferral.

If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies. However an inherited annuity is taxable. Income from annuities is taxed as ordinary income.

Also if the annuitant and owner are different beneficiaries younger than 59 12 are subject to an extra 10-percent tax penalty on paid-out earnings. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. The simplest option is to take the entire amount as a lump sum.

If you used pre-tax dollars to fund your initial deposit its a qualified annuity. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. An annuity that has been funded with previously untaxed funds is considered a qualified annuity.

Ad Learn More about How Annuities Work from Fidelity. But that doesnt mean theyre a way to avoid taxes completely. For example if the owner.

Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers. Ad Find Annuity Beneficiary Tax. Designating Others When you specify someone else as your beneficiary such as a child or spouse the money will pass by contract.

How Inherited Annuities Are Taxed. The way that any given annuity is taxed depends on the money used to set it up. If the annuity passes to the beneficiaries.

Depending on the payout structure as well as the beneficiarys relationship to the annuity owner the taxed. Any growth or earnings inside of an annuity are tax-deferred until you start receiving income from the annuity. The taxed amount depends on the payout structure and the beneficiarys relationship with the annuity owner as a surviving spouse or otherwise.

The IRS treats distributions paid to an annuitant from qualified. Ad Annuities are often complex retirement investment products. Annuities are tax deferred.

Living Abroad What About My South African Family Trust Family Trust South African South

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Annuity Beneficiaries Inheriting An Annuity After Death

Period Certain Annuity What It Is Benefits And Drawbacks

Secure Act Retirement Planning Opportunities And Challenges Retirement Planning Lifetime Income Financial Advisors

Annuity Beneficiaries Inherited Annuities Death

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

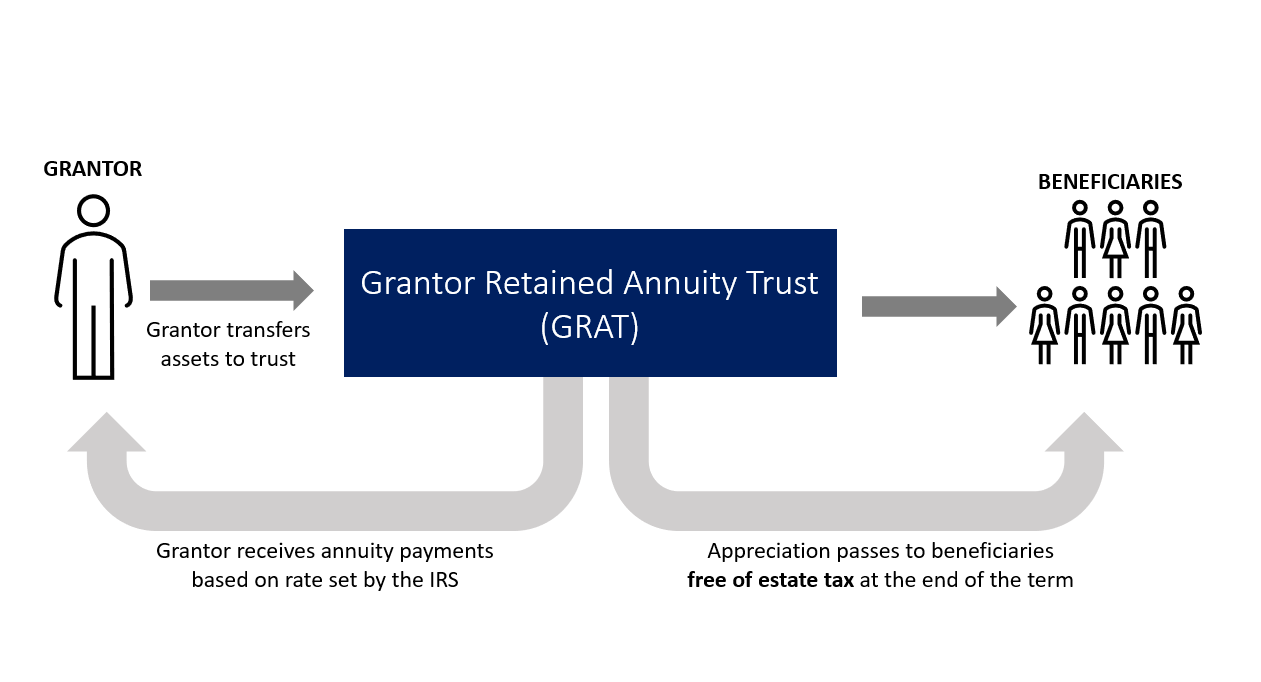

How To Use Grantor Retained Annuity Trusts Grats To Transfer Wealth To Beneficiaries Tax Free Plancorp

Compare Annuity Rates Annuity Lifetime Income Investment Advice

Difference Between Annuitant And Beneficiary Difference Between

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

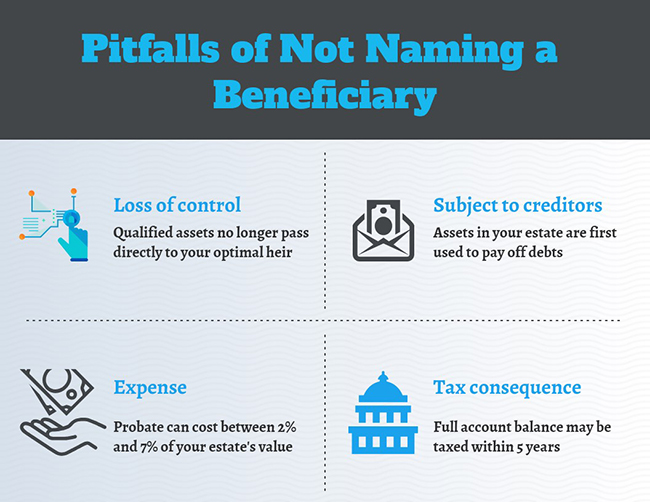

How Do Beneficiary Designations Affect Your Retirement Planning

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Annuity Beneficiaries Inheriting An Annuity At Death 2022

The Complete Guide To The Roth Ira Traditional Ira Roth Ira Retirement Accounts